Have you ever had the experience of selling a stock soon and only then watch it (with increasing frustration) to go up and up?

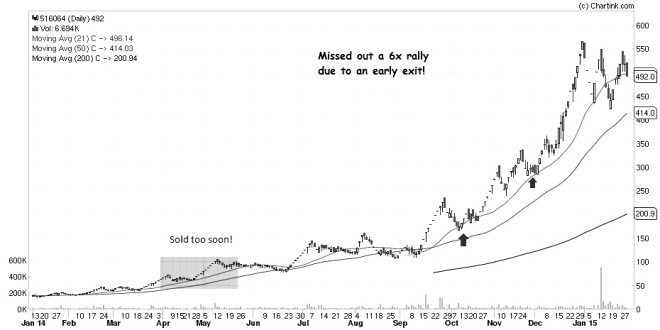

That has been my experience with Arrow Coated Products (ACP), which I came to know about from Valuepicks blog. Entered at 65, exited at 88 – roughly 33% within 45 days. Not a bad return. But, only if I waited for 7-8 more months! Well, only the consolation is that at least I have some splendid company. Even Prof. Sanjay Bakshi has had a similar experience with Eicher Motors.

The importance of mental clarity, be it for traders or investors, cannot be overstated. Identifying a stock to invest in would be most likely the easiest part of the whole process. Other key decisions, including position sizing and when to sell, can make or break a good investment.

My biggest lessons (or mistakes)

#1. Never confuse between trade and investment

ACP had strong fundamentals – 3 years ROE of 35%+, negligible debt and strong patent portfolio. I should have had the conviction and PATIENCE to stick on. Developing conviction definitely deserves another post.

#2. Most often, the best stock to buy is the stock you already own

I could have entered ACP again later at several price points and still tripled or doubled my money. But, I did not as I had mentally shut out myself to ACP and was looking for “next big winner”.

#3. Bet big

Wealth is not built by investing pennies. Even if I had held on to ACP till now, buying just 100 shares is not the way to improve wealth. Identifying stocks to invest is just a small portion of the story, a lot depends on how big your position is and how you decide to sell.